Reputation: 4821

Predict and plot after fitting `arima()` model in R

Just getting acquainted with time series, and using this R-bloggers post as a guide for the following exercise: the futile attempt to predict the future returns in the stock market... Just an exercise in understanding the concept of time series.

The problem is that when I plot the predicted values I get a constant line, which is at odds with the historical data. Here it is, in blue, at the tail end of the stationarized historical Dow Jones daily returns.

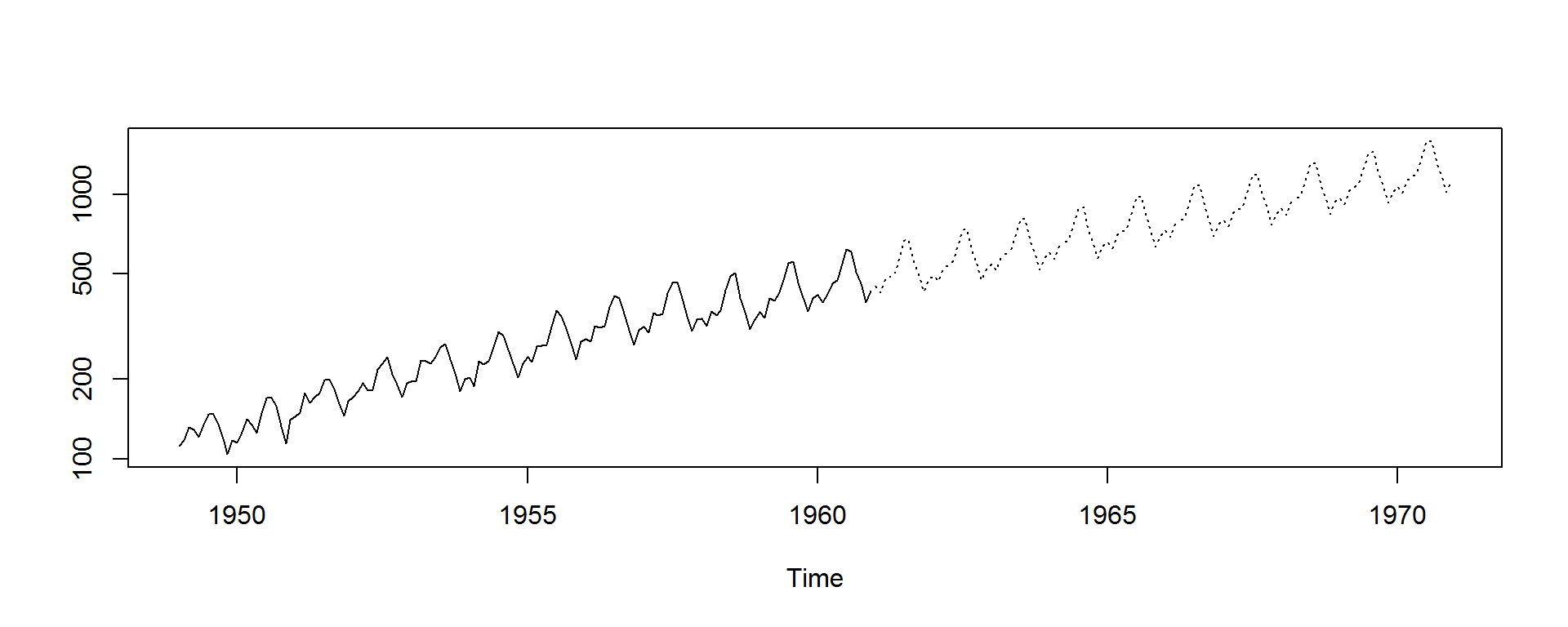

In reality I would like a more "optimistic" visual, or a "re-trended" plot such as the one I got for the predicted number of air travelers:

This is the code:

library(quantmod)

library(tseries)

library(forecast)

getSymbols("^DJI")

d = DJI$DJI.Adjusted

chartSeries(DJI)

adf.test(d)

dow = 100 * diff(log(d))[-1]

adf.test(dow)

train = dow[1 : (0.9 * length(dow))]

test = dow[(0.9 * length(dow) + 1): length(dow)]

fit = arima(train, order = c(2, 0, 2))

predi = predict(fit, n.ahead = (length(dow) - (0.9*length(dow))))$pred

fore = forecast(fit, h = 500)

plot(fore)

Unfortunately, I get an error if I try the same code use for the air travelers forecast. For example:

fit = arima(log(AirPassengers), c(0, 1, 1), seasonal = list(order = c(0, 1, 1), period = 12))

pred <- predict(fit, n.ahead = 10*12)

ts.plot(AirPassengers,exp(pred$pred), log = "y", lty = c(1,3))

applied to the current problem could possibly (?) go something like this:

fit2 = arima(log(d), c(2, 0, 2))

pred = predict(fit2, n.ahead = 500)

ts.plot(d,exp(pred$pred), log = "y", lty = c(1,3))

Error in .cbind.ts(list(...), .makeNamesTs(...), dframe = dframe, union = TRUE) : non-time series not of the correct length

Upvotes: 4

Views: 4910

Answers (1)

Reputation: 4821

Making some progress, and the OP is too long as it is.

- From not working at all to working a bit: Or why I was getting the "non-time series not of the correct length" and other cryptic error messages... Well, without knowing details, it just occurred to me to check what I was trying to

cbind.ts:is.ts(d) [1] FALSEAha! Even ifdis anxtsobject, it is not a time series. So I just had to runas.ts(d). Solved! Unrealistically flat market predictions: Plotting it now as

fit2 = arima(log(d), c(2, 1, 2)); pred = predict(fit2, n.ahead = 365 * 5)ts.plot(as.ts(d),exp(pred$pred), log = "y", col= c(4,2),lty = c(1,3), main="VIX = 0 Market Conditions", ylim=c(6000,20000))

OK... No prospects for a job at Goldman Sachs with this flat prospect. I need to entice some investors. Let's cook up this snake's oil some more:

Getting the flat line going: Let's add up the "seasonality" and we are ready to party like it's 1999:

fit3 = arima(log(d), c(2, 1, 2), seasonal=list(order = c(0, 1, 1), period=12))pred = predict(fit3, n.ahead = 365 * 5)ts.plot(as.ts(d),exp(pred$pred), log = "y", col= c(2,4),lty = c(1,3), main="Investors Prospectus - Maddoff & Co., Inc.")

- Almost there: I went to John Oliver's page and printed a certificate as an official financial advisor, so I am ready to take your retirement money. In order to do so, I just need to express some healthy uncertainty in this bullish prospect for the next five years. Easy, peasy...

fore = forecast(fit2, h = 365 * 5); plot(fore), and voilà...

Oh, no! No way I'm getting any dopes to invest with this reality check... Good thing I didn't quit my daytime job... Wait a second, I messed up entering the model: fore = forecast(fit3, h = 365 * 5) plot(fore):

I'm heading to Staples...

Upvotes: 2

Related Questions

- Time Series Forecast using Arima in R

- Plot Arima: Actual vs Predicted

- Plot initial data and predicted data (aima model) in R

- In R plot arima fitted model with the original series

- Plot forecast and actual values

- ARIMA fitted values

- arima: How can I get fitted ARIMA time series?

- How to plot model with forecasts in R?

- Cannot reproduce the prediction made by arima

- forecasting arima in R